Zenverge founders, Amir Mobini and Tony Masterson, honed up on their MPEG technology prowess with startup iCompression (founded 1996) and later at Globespan which acquired the startup in May 2000 for $400 million -- just as the tech boom was peaking. Working together for 14 years, they were developing MPEG encoding products which became a hot tech subject in the late 1980s and PVRs were making their debut in the consumer market. At iCompression, the pair worked on low-cost, real-time MPEG2 video/audio/system encoders for consumer and PC markets. At Globespan, Mobini served as an engineering director and helped develop the world's first fully integrated MPEG-2 encoder and codec ICs. Eventually, GlobespanVirata spun out the video technology to form Conexant Systems and its MPEG encoding business ramped up to about $30 million annual run rate by 2005.

By the middle of the decade, the semiconductor industry had gone through massive reorganizations as the then hyper-valued chip entities were deflated by investors. Valuations nose-dived and the industry went through a retrenchment and consolidation period.

In 2005, Mobini and Masterson decided to form their own venture but the operation did not officially start until January 2006 The foundation of the company, then named Xilient, emerged from analyzing the video trends and upcoming technologies at the time, such as the emergence of h.264, HD, and others. In essence, MPEG content was being broadcast to the home and it needed to be distributed to other devices and screens without running extra wiring and putting expensive set-top boxes (STBs) around the house.

Prior to iCompression, Mobini did engineering stints at Oak Technology and IBM. Masterson, earlier, held IC development posts at workstation maker, SGI, and at Apple Computer.

As a historical footnote, Xilient was renamed to Zenverge in 2009 because Xilinx claimed that the first part of the company's named, i.e., "Xili" caused possible confusion. We would speculate that the new name Zenverge is intended to signify the act of making an intuitive convergence ('Zen') of all the different media formats.

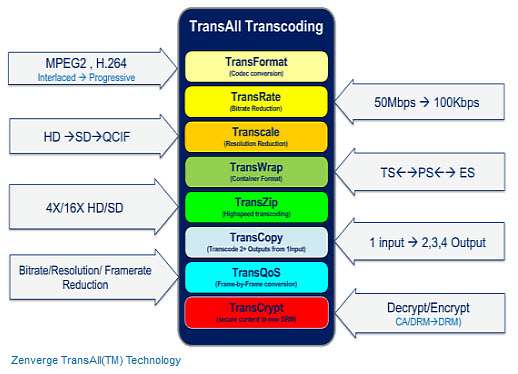

Most broadcast content today is either MPEG2 or AVC but with high resolutions, such as 1080i. With its technology, Zenverge can process 4 HD streams simultaneously to any bit-rate, any resolution or profile -- each having a totally independent profile (MPEG2 or AVC). The founders looked around the landscape and saw that other companies were doing transcoding but in ways that were not cost-effective and took up significant die area. A video transcoder takes video in one format and converts it into a different format with the goal of bit-rate reduction, resolution change and/or format conversion.

Zenverge's transcoding process is done in a single IP block. The company realized when video is being processed, either on the encode or decode side, it could have huge bandwidth constraints on the memory. To mitigate it, the Zenverge design minimizes the memory requirement during the processing. The company claims it needs only two DDR memory parts compared to four from other vendors to process four video streams. The company calls it the "TransAll™ transcoding engine."

In 2005, Mobini and Masterson decided to form their own venture but the operation did not officially start until January 2006 The foundation of the company, then named Xilient, emerged from analyzing the video trends and upcoming technologies at the time, such as the emergence of h.264, HD, and others. In essence, MPEG content was being broadcast to the home and it needed to be distributed to other devices and screens without running extra wiring and putting expensive set-top boxes (STBs) around the house.

Prior to iCompression, Mobini did engineering stints at Oak Technology and IBM. Masterson, earlier, held IC development posts at workstation maker, SGI, and at Apple Computer.

As a historical footnote, Xilient was renamed to Zenverge in 2009 because Xilinx claimed that the first part of the company's named, i.e., "Xili" caused possible confusion. We would speculate that the new name Zenverge is intended to signify the act of making an intuitive convergence ('Zen') of all the different media formats.

Most broadcast content today is either MPEG2 or AVC but with high resolutions, such as 1080i. With its technology, Zenverge can process 4 HD streams simultaneously to any bit-rate, any resolution or profile -- each having a totally independent profile (MPEG2 or AVC). The founders looked around the landscape and saw that other companies were doing transcoding but in ways that were not cost-effective and took up significant die area. A video transcoder takes video in one format and converts it into a different format with the goal of bit-rate reduction, resolution change and/or format conversion.

Zenverge's transcoding process is done in a single IP block. The company realized when video is being processed, either on the encode or decode side, it could have huge bandwidth constraints on the memory. To mitigate it, the Zenverge design minimizes the memory requirement during the processing. The company claims it needs only two DDR memory parts compared to four from other vendors to process four video streams. The company calls it the "TransAll™ transcoding engine."

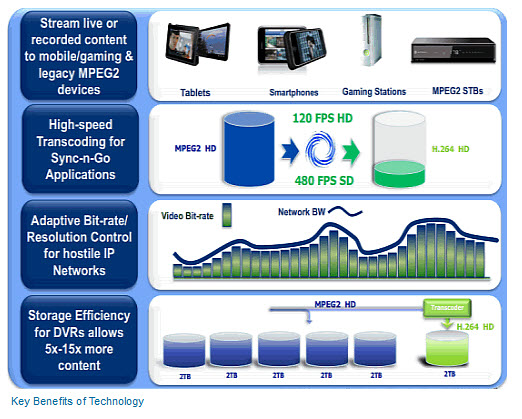

By 2006, the company was able to prove its technology concept which entailed audio/video processing at lower cost to meet the consumer price points. The company was formed with the premise to take multiple channels of HD, process the streams, and fit the content into the available channel bandwidth of the target device. The content operators also saw the opportunity to bring a single gateway to the house and distribute the content throughout the house from the gateway--realizing significant money savings from not having a $300 set-top-box (STB) located at every TV. Additionally, the single gateway model eliminates truck rolls, further saving cost for the operator. The gateway also enabled streaming content to tablets and smartphones. By the nature of the technology's efficient compression, operators were also set to benefit from being able to store significantly more content in the same size disk drive. The gateway enables consumers to attach their own hardware to the network. For them, an advantage of the gateway is the elimination of extra smartcards or cable cards since one card is shared by the gateway --resulting in typically $100 savings in a 4 STB home.

The operators started to adopt the gateway model four years ago and Zenverge sees this model being adopted worldwide. The first gateway devices are expected to hit the market later in 2013. Zenverge announced the XG5 gateway product based on Zenverge chips for Comcast's gateway box which Harris is building for them. Motorola also announced a gateway box in conjunction with Verizon.

The gateway box is a single box that handles all video data and voice services. Its sits where broadband connection enters the house and connects the home network, mostly over MoCA coax infrastructure. Content is streamed to all devices/TVs in the house with a thin client and to tablets/smartphones using WiFi. In the short term, customers will be relying on the operators to supply the modem precluding the ability to buy a third-party modem which may be better and save on modem rental charges. Longer term, Zenverge believes that these devices will be available at retail also.

The company will be also benefitting from the trend in open source set-top-boxes. Currently, it takes about two years to deliver a new set-top box from the design stage into a customer's home. However, over the past few years, Comcast has been developing its Comcast Reference Development Kit (RDK) to cut that innovation cycle in half. The Comcast RDK was developed internally using open-source components and by working with various vendors. The RDK is a community-based project that allows developers, vendors and cable operators to use a defined stack of software on one layer in order to provision set-top boxes and gateways. The effort is somewhat analogous to the Android OS deployment which accelerated the market penetration of new devices.

The first early operator adopter in the USA was Tivo which build a gateway-like adaptor that attaches to the home network. The unit connects to the user's wireless router and sees the user's Tivo DVR boxes on the home network. It streams from those DVRs either the tuner or the stored content on the hard disk drives to tablets and syncs the content for later viewing on the tablet. Tivo ships products for the retail market and has business relationships with pay TV providers.

Tivo has various pay-TV industry relationships, such as RCN and SuddenLink. The company also made cable deals with U.S. partners Mediacom, Midcontinent, and Cable ONE to expand its partner footprint. Overseas it made deals with Virgin Media in the U.K., ONO in Spain, and Com Hem in Scandinavia.

The Arris Group has designed in the ZN200 for a new class of 'headless' video gateway box that is based on Comcast's XG5 RDK. The ARRIS MG2402 Gateway was on display CES six months ago. The box is considered headless because it does not do video rendering functions which 'headed' set-top boxes perform.

Motorola Mobility LLC-made Televation, a cableCard based system has Zenverge designed in. Comcast markets the product under the AnyPlay brand. Motorola, which is a C-round strategic investor, is working on a multi-stream version of Televation.

Earlier, Zenverge chips were incorporated in an LG product in Korea and in an SKnet product in Japan.

The early stage funding came from Doll Capital Management (DCM) and Norwest Venture Partners (NV).

In April 2010, Zenverge's C funding round saw its funding stash increase by $30 million. Led by Battery Ventures, past investors, DCM, NVP, and Motorola Ventures joined in the financing.

The series D funding came to fruition in May 2011 totaling $20.5 million. The round was led by fabless semiconductor company Entropic Communications (NASDAQ: ENTR), with participation from new investors, CID Group and Woodside Fund and existing investors DCM, Norwest Venture Partners (NVP), Motorola Mobility Ventures, and Battery Ventures. Entropic put in $10 million of the total. We would consider the Entropic cash infusion strategic because of Entropic's co-development program with Zenverge. San Diego-based Entropic wants to put its MoCA functionality on the same silicon with Zenverge's transcoding technology.

As part of a comprehensive development deal inked in May 2011, the Entropic and Zenverge are co-developing solutions and aligning product roadmaps for the delivery of content with powerful transcoding technology over a MoCA® 2.0 (Multimedia over Coax) home network. Entropic's investment in Zenverge attests to the importance of the deal.

The partnership with Zenverge allows Entropic add more functions to its chips -- making them more attractive to set top box makers. The San Diego company faces stiff competition from Irvine digital signal chip giant Broadcom. While Entropic's latest version of whole-home DVR chips are more powerful than Broadcom's, Entropic faces a market hurdle because it sells its chips on a stand- alone basis. Broadcom, on the other hand, integrates its whole-home DVR technology into a chip set that powers several other functions inside set top boxes. Manufacturers tend to prefer integrated chips because it lessens the risk that components from different suppliers won't work together.

In August 2012, another strategic round of financing was received from Verizon Investments LLC, a subsidiary of Verizon Communications, with participation from Zenverge's existing investors. Verizon Investments is an affiliate of Verizon Ventures, the strategic venture capital arm for Verizon.

All in all, InsideChips believes that about $80 million has been invested in Zenverge to date in five funding rounds. Zenverge is using the funds to accelerate support and growth to expand adoption for its existing products, develop unified solutions for the cable, telco and satellite markets with Entropic and continue its development activities.

The operators started to adopt the gateway model four years ago and Zenverge sees this model being adopted worldwide. The first gateway devices are expected to hit the market later in 2013. Zenverge announced the XG5 gateway product based on Zenverge chips for Comcast's gateway box which Harris is building for them. Motorola also announced a gateway box in conjunction with Verizon.

The gateway box is a single box that handles all video data and voice services. Its sits where broadband connection enters the house and connects the home network, mostly over MoCA coax infrastructure. Content is streamed to all devices/TVs in the house with a thin client and to tablets/smartphones using WiFi. In the short term, customers will be relying on the operators to supply the modem precluding the ability to buy a third-party modem which may be better and save on modem rental charges. Longer term, Zenverge believes that these devices will be available at retail also.

The company will be also benefitting from the trend in open source set-top-boxes. Currently, it takes about two years to deliver a new set-top box from the design stage into a customer's home. However, over the past few years, Comcast has been developing its Comcast Reference Development Kit (RDK) to cut that innovation cycle in half. The Comcast RDK was developed internally using open-source components and by working with various vendors. The RDK is a community-based project that allows developers, vendors and cable operators to use a defined stack of software on one layer in order to provision set-top boxes and gateways. The effort is somewhat analogous to the Android OS deployment which accelerated the market penetration of new devices.

The first early operator adopter in the USA was Tivo which build a gateway-like adaptor that attaches to the home network. The unit connects to the user's wireless router and sees the user's Tivo DVR boxes on the home network. It streams from those DVRs either the tuner or the stored content on the hard disk drives to tablets and syncs the content for later viewing on the tablet. Tivo ships products for the retail market and has business relationships with pay TV providers.

Tivo has various pay-TV industry relationships, such as RCN and SuddenLink. The company also made cable deals with U.S. partners Mediacom, Midcontinent, and Cable ONE to expand its partner footprint. Overseas it made deals with Virgin Media in the U.K., ONO in Spain, and Com Hem in Scandinavia.

The Arris Group has designed in the ZN200 for a new class of 'headless' video gateway box that is based on Comcast's XG5 RDK. The ARRIS MG2402 Gateway was on display CES six months ago. The box is considered headless because it does not do video rendering functions which 'headed' set-top boxes perform.

Motorola Mobility LLC-made Televation, a cableCard based system has Zenverge designed in. Comcast markets the product under the AnyPlay brand. Motorola, which is a C-round strategic investor, is working on a multi-stream version of Televation.

Earlier, Zenverge chips were incorporated in an LG product in Korea and in an SKnet product in Japan.

The early stage funding came from Doll Capital Management (DCM) and Norwest Venture Partners (NV).

In April 2010, Zenverge's C funding round saw its funding stash increase by $30 million. Led by Battery Ventures, past investors, DCM, NVP, and Motorola Ventures joined in the financing.

The series D funding came to fruition in May 2011 totaling $20.5 million. The round was led by fabless semiconductor company Entropic Communications (NASDAQ: ENTR), with participation from new investors, CID Group and Woodside Fund and existing investors DCM, Norwest Venture Partners (NVP), Motorola Mobility Ventures, and Battery Ventures. Entropic put in $10 million of the total. We would consider the Entropic cash infusion strategic because of Entropic's co-development program with Zenverge. San Diego-based Entropic wants to put its MoCA functionality on the same silicon with Zenverge's transcoding technology.

As part of a comprehensive development deal inked in May 2011, the Entropic and Zenverge are co-developing solutions and aligning product roadmaps for the delivery of content with powerful transcoding technology over a MoCA® 2.0 (Multimedia over Coax) home network. Entropic's investment in Zenverge attests to the importance of the deal.

The partnership with Zenverge allows Entropic add more functions to its chips -- making them more attractive to set top box makers. The San Diego company faces stiff competition from Irvine digital signal chip giant Broadcom. While Entropic's latest version of whole-home DVR chips are more powerful than Broadcom's, Entropic faces a market hurdle because it sells its chips on a stand- alone basis. Broadcom, on the other hand, integrates its whole-home DVR technology into a chip set that powers several other functions inside set top boxes. Manufacturers tend to prefer integrated chips because it lessens the risk that components from different suppliers won't work together.

In August 2012, another strategic round of financing was received from Verizon Investments LLC, a subsidiary of Verizon Communications, with participation from Zenverge's existing investors. Verizon Investments is an affiliate of Verizon Ventures, the strategic venture capital arm for Verizon.

All in all, InsideChips believes that about $80 million has been invested in Zenverge to date in five funding rounds. Zenverge is using the funds to accelerate support and growth to expand adoption for its existing products, develop unified solutions for the cable, telco and satellite markets with Entropic and continue its development activities.

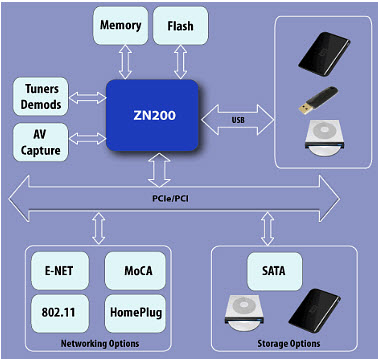

Zenverge's current flagship product is the ZN200 which is touted as the world's most advanced quad-stream content network SoC which can transcode up to four HD streams at the same time with the least amount of DDR memory of any part in the market today. Zenverge chose four HD streams in its chip functionality because content operators typically have four devices in the home.

In addition to the ZN200, the company offers a lower-priced two HD channel transcoder (ZN180) and a dedicated dual stream co-processor (ZN180).

- Features of the ZN200 include:

- Quad Stream HD Transcoder SOC or Co-processor

- Multi-format video encode and transcode engine

o H.264 up to L4.2@HP, MPEG-2 up to HL@MP

o Transcoding - MPEG2 <--> H.264

o Transrating - HD bitrates or lower

o Transcaling - HD resolutions or lower - Multi-format audio encoder and transcoder

- Transcryption of CA/DRM

- Multiple system interfaces

In addition to the ZN200, the company offers a lower-priced two HD channel transcoder (ZN180) and a dedicated dual stream co-processor (ZN180).

Zenverge also offers the ZN2000, the professional infrastructure application version of the ZN200 for cloud infrastructure which not only handles 4 HD channels simultaneously but gives designer ability to put multiple chips on a PCIE board. For example, a rack solution using this approach could process hundreds of channels of HD content. Such a system product could process many channels of HD and transcode them for live streaming applications, and the next generation of video streaming where operators gain the ability to perform a dedicated transcoding session in the cloud.

In its longer term vision, Zenverge believes that like VoiP with 256 voice channels, services like Netlix and Hulu will move to keep their content in its highest quality format and use dedicated transcoder ports to connect to user sessions to transcode the video to conditions that the user prefers. Today, Netflix stores hundreds of variations of the same file in its hard disk drives at their data center. When a user connects to the content, its servers basically switch to different versions of that content depending on the user device capability and network conditions.

The market for these advanced chips used in video datacenters could be in hundreds of thousands. The early adopters of the model are hospitality and hotel oriented applications and multi-tenant dwellings.

The competition comes from several bigger players and a handful of startups. Most significantly, Broadcom will be an increasingly bigger threat since the chip giant has the financial muscle to acquire companies to better compete in markets it goes after. Up to now Broadcom's products have utilized a brute force approach for transcoding. Often, Zenverge chips sit next to Broacom and Intel SoCs which perform network processing and display functions.

Zenverge's most direct competitor is ViXS of Toronto, Canada. ViXS was founded five years before Zenverge and claims to have amassed a technology arsenal of 400+ patents awarded or pending. The Canadian venture-backed firm enjoys an early start and stated that it has made more than 30 million unit shipments to date. InsideChips believes that the company reached about $35 million in sales in the past 12 months, but has suffered substantial losses during that period.

Nevertheless, ViXS represents a market threat to Zenverge since it has garnered market traction and recently it has successfully completed a private placement and merged with W7 Acquisition Corp. closing $57 million in new funds. The move will make ViXS a public company.

Larger competitors are struggling with current standards using outdated technologies. Other competitors do pieces of the product functions that Zenverge focuses on. Magnum Semiconductor, for example, which has codec technology, is mainly serving the professional head end equipment space and is not a direct competitor.

Zenverge operates with a staff totaling 100 employees with headquarters based in Santa Clara, Calif. and a design center operation in Bangalore, India. About 30% of the workforce is located in India. The India operation has grown organically as several of the staff wished to return to India. The operation increased in size substantially in the past few years and will be a key adjunct to the Silicon Valley development efforts -- especially the software-related algorithmic R&D.

In addition to founders Mobini and Masterson, Zenverge's management lineup includes:

Zenverge is well funded and operates with a diversified management team with a core team coming from Conexant via the iCompression merger who are familiar with each others management style. The company's decision early on to go back to the drawing board to create an architecture which is scalable and memory bandwidth efficient should continue to pay off in the future as processing demands increase. The company's ability to maintain its cost competitiveness by having the lowest silicon footprint per channel of HD will be a key factor. One of the key selling points to prospective customers is that its solution requires less than half the external memory needed by its competitors to process eight channels of HD.

Scalability of the technology is a big issue which will allow Zenverge to introduce SoCs with very competitive die sizes as it moves to the next generation process geometries. Also, the company's four HD stream offering is adequate, future options might include a six stream chip which would be with widely used 6-stream cable cards.

Zenverge's bigger rivals are essentially duplicating pipelines to address each channel of HD which creates die area inefficiencies and redundancies. Competitors are also using separate memory busses for each of the pipelines demanding larger memory resources.

Zenverge is creating architectures which are more efficient in die area footprint and memory usage -- giving it what it believes is a sustainable advantage. Zenverge boasts of 38 relevant patents received or pending to back up its claim.

With the cost performance metrics that Zenverge claims, the company will come under the scrutiny of bigger worldwide chip suppliers as the market expands dramatically in the next three years. With the number of innovative startups limited in the home networking transcoding space, Zenverge is a likely candidate for future acquisition.

Contact:

Zenverge, Inc.

3960 Freedom Circle, Suite 100,

Santa Clara, CA 95054

Tel: 408 350 5052

Fax: 408 673 2272

India Design Center:

No.135, 1st Floor, Infantry Road

Bangalore 56001 India

Tel: +91 80 22863283

In its longer term vision, Zenverge believes that like VoiP with 256 voice channels, services like Netlix and Hulu will move to keep their content in its highest quality format and use dedicated transcoder ports to connect to user sessions to transcode the video to conditions that the user prefers. Today, Netflix stores hundreds of variations of the same file in its hard disk drives at their data center. When a user connects to the content, its servers basically switch to different versions of that content depending on the user device capability and network conditions.

The market for these advanced chips used in video datacenters could be in hundreds of thousands. The early adopters of the model are hospitality and hotel oriented applications and multi-tenant dwellings.

The competition comes from several bigger players and a handful of startups. Most significantly, Broadcom will be an increasingly bigger threat since the chip giant has the financial muscle to acquire companies to better compete in markets it goes after. Up to now Broadcom's products have utilized a brute force approach for transcoding. Often, Zenverge chips sit next to Broacom and Intel SoCs which perform network processing and display functions.

Zenverge's most direct competitor is ViXS of Toronto, Canada. ViXS was founded five years before Zenverge and claims to have amassed a technology arsenal of 400+ patents awarded or pending. The Canadian venture-backed firm enjoys an early start and stated that it has made more than 30 million unit shipments to date. InsideChips believes that the company reached about $35 million in sales in the past 12 months, but has suffered substantial losses during that period.

Nevertheless, ViXS represents a market threat to Zenverge since it has garnered market traction and recently it has successfully completed a private placement and merged with W7 Acquisition Corp. closing $57 million in new funds. The move will make ViXS a public company.

Larger competitors are struggling with current standards using outdated technologies. Other competitors do pieces of the product functions that Zenverge focuses on. Magnum Semiconductor, for example, which has codec technology, is mainly serving the professional head end equipment space and is not a direct competitor.

Zenverge operates with a staff totaling 100 employees with headquarters based in Santa Clara, Calif. and a design center operation in Bangalore, India. About 30% of the workforce is located in India. The India operation has grown organically as several of the staff wished to return to India. The operation increased in size substantially in the past few years and will be a key adjunct to the Silicon Valley development efforts -- especially the software-related algorithmic R&D.

In addition to founders Mobini and Masterson, Zenverge's management lineup includes:

- Raghu Rao, executive VP of world wide sales (ex-Marvell Semiconductor, GlobeSpanVirata/Conexant Systems, TeraLogic/Zoran, LSI Logic, DEC)

- Shawn Saleem, executive VP of marketing and strategy planning (ex-Cignias, ViXS Systems, ATI)

- Toshio Matsumoto, VP of business development (ex-Conexant, iCompression, Arithmos)

- Kent Goodwin, executive VP of engineering (ex-Silicon Optix, Parama Networks, Mediamatics/National Semiconductor, Weitek)

- Robert Bagheri, executive VP of operations (ex-AMCC, Silicon Image, SiRF, S3, Zoran)

- Deb Chartterjee, VP of algorithms and India operations (ex-Xambala, PortalPlayer, iCompression)

- Craig Garber, CFO (ex-Element Labs, SiTime, Applied Materials, Lam Research)

Zenverge is well funded and operates with a diversified management team with a core team coming from Conexant via the iCompression merger who are familiar with each others management style. The company's decision early on to go back to the drawing board to create an architecture which is scalable and memory bandwidth efficient should continue to pay off in the future as processing demands increase. The company's ability to maintain its cost competitiveness by having the lowest silicon footprint per channel of HD will be a key factor. One of the key selling points to prospective customers is that its solution requires less than half the external memory needed by its competitors to process eight channels of HD.

Scalability of the technology is a big issue which will allow Zenverge to introduce SoCs with very competitive die sizes as it moves to the next generation process geometries. Also, the company's four HD stream offering is adequate, future options might include a six stream chip which would be with widely used 6-stream cable cards.

Zenverge's bigger rivals are essentially duplicating pipelines to address each channel of HD which creates die area inefficiencies and redundancies. Competitors are also using separate memory busses for each of the pipelines demanding larger memory resources.

Zenverge is creating architectures which are more efficient in die area footprint and memory usage -- giving it what it believes is a sustainable advantage. Zenverge boasts of 38 relevant patents received or pending to back up its claim.

With the cost performance metrics that Zenverge claims, the company will come under the scrutiny of bigger worldwide chip suppliers as the market expands dramatically in the next three years. With the number of innovative startups limited in the home networking transcoding space, Zenverge is a likely candidate for future acquisition.

Contact:

Zenverge, Inc.

3960 Freedom Circle, Suite 100,

Santa Clara, CA 95054

Tel: 408 350 5052

Fax: 408 673 2272

India Design Center:

No.135, 1st Floor, Infantry Road

Bangalore 56001 India

Tel: +91 80 22863283

RSS Feed

RSS Feed